Deciding to go back to school is a massive step, and let's be honest, the first question on everyone's mind is usually "How on earth can I afford this?" The great news is that student finance for mature students isn't just an afterthought; it’s a dedicated system designed to help people just like you get back into education. You absolutely can get the financial backing you need to chase those university ambitions.

Funding Your Return to Education

Thinking about swapping your current routine for lecture halls and libraries can feel a bit daunting, especially when it comes to the money side of things. It’s a common myth that student funding is only for fresh-faced school leavers. The reality? There’s a solid support system in place to help you invest in your future, no matter your age.

Think of this guide as your personal roadmap. We're going to break down the entire financial toolkit available to you, cutting through the confusing jargon. Our goal is to show you that a university degree is well within your reach, regardless of where you are in life.

Your Financial Toolkit Overview

The support on offer is much more than a single loan. It's actually a package of different funding streams, each designed to cover a specific part of student life. Getting your head around these is the first step to building a solid financial plan.

Here are the key bits of funding you need to know about:

- Tuition Fee Loan: This is the big one. It covers the entire cost of your course fees and gets paid directly to your university. That means you don’t have to find thousands of pounds upfront. Phew.

- Maintenance Loan: This loan is for you. It's designed to help with living costs—think rent, bills, food, and travel. The amount you get depends on your household income and where you’ll be studying.

- Extra Support: On top of the main loans, there are often extra grants and allowances for students with children or dependents, disabilities, or specific learning difficulties. These don't usually have to be paid back.

For many mature learners, the biggest lightbulb moment is realising that things like having a mortgage or a less-than-perfect credit history don't automatically rule you out. The system is designed to look at your current circumstances, not to penalise you for having lived a life before deciding to study.

Of course, money is only one piece of the puzzle. As you sort out your funding, it’s just as important to think about the bigger picture. Brushing up on strategies for college success can make the transition back to academic life much smoother. And if you ever need a motivational boost, reminding yourself why university is worth it even as a mature student will help keep your eyes on the prize.

UK Student Finance Options for Mature Students at a Glance

To make things even clearer, here's a quick summary of the main financial support types available to help you plan your studies.

| Funding Type | What It Covers | How It's Assessed |

|---|---|---|

| Tuition Fee Loan | The full cost of your university course fees. | Not based on household income. Almost all eligible UK students can get this. |

| Maintenance Loan | Day-to-day living costs like rent, food, and bills. | Based on your household income and where you live/study. |

| Extra Grants | Specific needs, e.g., childcare or disability support. | Based on your specific circumstances, like having dependents or a disability. |

This table should give you a good starting point for figuring out what you might be entitled to. Remember, each element is designed to work together to give you the comprehensive support you need to focus on your studies, not just your finances.

Of course! Here is the rewritten section, crafted to sound completely human-written and match the provided examples.

Who Qualifies for Mature Student Finance?

Thinking about going back to education is exciting, but the first real hurdle is often figuring out if you can get any financial support. The rules can look a bit daunting at first glance, but once you break them down, they're much more straightforward than they seem. It’s not just about your age; it's more like a simple checklist to see where you stand.

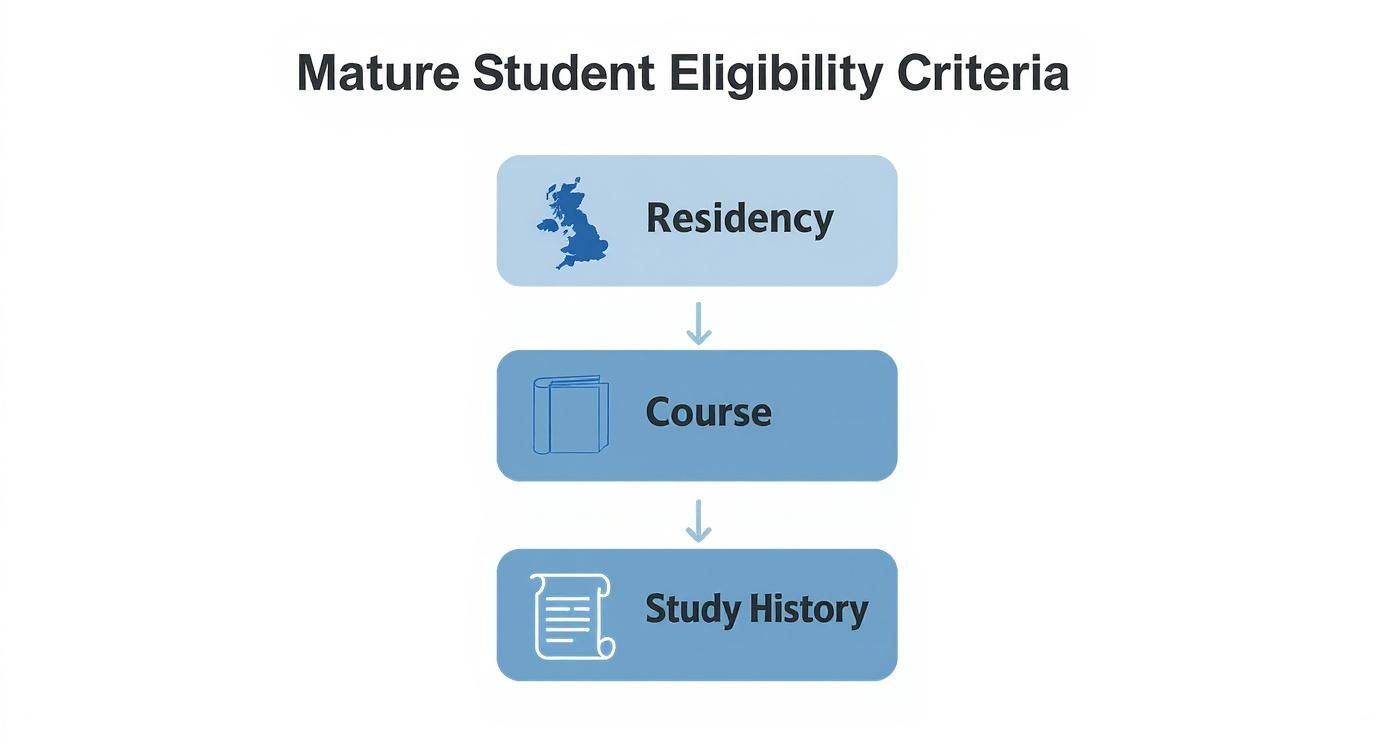

The main things that determine if you're eligible for student finance boil down to three key areas: where you live, what course you want to study, and what you’ve studied in the past. Getting a clear picture of these will give you the confidence you need to take the next step.

Your Residency and Nationality

The first checkpoint is pretty simple: you need to have the right to access public funds in the UK. To get the full support package – that’s both the tuition fee loan and the maintenance loan to help with living costs – you’ll generally need to tick a few boxes.

Typically, this means you:

- Are a UK national or have ‘settled status’ (which means there are no restrictions on how long you can stay).

- Normally live in England, Wales, Scotland, or Northern Ireland.

- Have been living in the UK, the Channel Islands, or the Isle of Man for the three full years right before the first day of your course.

There are, of course, some exceptions for people like EU nationals, refugees, or those with specific types of leave to remain, but that three-year residency rule is the one that applies to most people. It's just to make sure the funding goes to those who have established ties to the UK.

Your Course and University

Not every single course out there is eligible for funding, so it’s important to check this one off your list. The course you choose and the place you study it have to be officially recognised. This just means you need to be studying for a proper higher education qualification at a registered UK university or college.

Most of the usual qualifications are covered, including:

- A first degree (like a BA, BSc, or BEd)

- A Foundation Degree

- A Higher National Diploma (HND)

- A Diploma of Higher Education (DipHE)

It also matters whether you plan to study full-time or part-time. The good news is that both routes are supported. For part-time study, the amount of funding you can get often depends on your ‘course intensity’ – basically, how much of your course you get through each year compared to a full-timer.

The official government website has some handy tools to check your eligibility before you even start an application.

This is the main starting point for all student finance applications in the UK. As you can see, it directs you to the right portal depending on which country you live in. This is your gateway to applying for tuition fee loans, maintenance loans, and any extra help you might be entitled to.

Your Previous Study History

This is the bit that often catches mature students out. A question we hear all the time is, "What if I already have a degree, or I started one years ago but never finished?" The general rule of thumb is that student finance is for your first higher education qualification.

If you already hold a degree, you usually won't be able to get another tuition fee or maintenance loan for a second one at the same level. However – and this is a big however – there are some really important exceptions for certain high-priority subjects like some healthcare courses, where you might still get funding.

Think about someone like David, a 45-year-old who went to uni in his twenties but dropped out after the first year. Because he never actually finished and got the qualification, he would most likely still be able to get funding for a new degree, although his entitlement might be reduced by one year to account for the year he already had.

The support available for mature students is designed to recognise that they often have different financial responsibilities. Everything from Tuition Fee Loans to Maintenance Loans is tailored based on things like your household income and where you live. For example, a mature student from a low-income household living away from home in London could get up to £13,762 as a maintenance loan, while the same student living outside London might get £10,544. To get a clearer idea of what you might receive, it’s worth exploring the detailed breakdown of mature student loans on Save the Student.

Building Your Student Funding Package

Think of your student finance not as a single lump sum, but as a complete funding package made up of different parts, all working together to support you. Getting your head around each component is the secret to building a solid financial plan for your studies. It’s a bit like putting together a toolkit where every tool has a specific job, from covering your course fees to helping with the weekly food shop.

Let's unpack what’s inside this package. We’ll look at the main loans that form the foundation of your funding and then explore the extra grants that can provide a crucial top-up. This way, you’ll see how everything fits together to create a proper financial safety net.

The Two Core Loans

At the heart of nearly every student’s funding are two main loans designed to tackle the biggest costs of university life: the Tuition Fee Loan and the Maintenance Loan. These are the bedrock of the student finance system here in the UK.

- Tuition Fee Loan: This one is nice and simple. It pays for your course fees and is sent straight to your university or college. You never actually see this money in your bank account, which takes away the stress of having to find thousands of pounds upfront.

- Maintenance Loan: This is the loan for your living costs. It lands in your bank account in three instalments throughout the year and is there to help with rent, bills, food, and all those other day-to-day expenses.

The infographic below breaks down the key things that determine whether you can get access to this core funding.

As you can see, your residency status, your chosen course, and any previous study are the first hurdles to clear when applying for student finance.

How Your Maintenance Loan Is Calculated

Unlike the Tuition Fee Loan, the Maintenance Loan isn't a one-size-fits-all amount. How much you get is "means-tested," which is just a formal way of saying it’s based on your household income. For many mature students, this is a big change from how younger applicants are assessed.

If you're over 25 and live with a partner, their income will probably be included in the assessment. Student Finance England will look at your combined earnings from a previous tax year to figure out how much support you need.

The thinking behind this is pretty straightforward: your household's financial situation is looked at as a whole to determine your living cost support. The higher the household income, the lower the Maintenance Loan, as the government assumes you can contribute more towards your own living costs.

The amount you can get also changes depending on where you’ll be living while you study. The table below shows that students in London receive a higher rate to help with the capital’s steeper living costs.

Maintenance Loan Entitlements Based on Living Situation

| Living Arrangement | Maximum Loan Outside London | Maximum Loan in London |

|---|---|---|

| Living with parents | £8,610 | £11,409 |

| Living away from home | £10,227 | £13,348 |

This tiered system helps ensure the support you receive is actually relevant to your real-world expenses.

Exploring Extra Grants and Allowances

Beyond the two main loans, there’s extra help available that you don’t have to pay back. This is where you can really tailor your funding package to your personal situation. These grants are designed to remove financial barriers that might otherwise stop you from getting back into education.

You may be eligible for extra support if you have:

- Children or dependent adults: Grants like the Childcare Grant and Parents' Learning Allowance can make a massive difference.

- A disability or long-term health condition: The Disabled Students' Allowance (DSA) helps cover study-related costs that arise from a mental health problem, long-term illness, or any other disability.

- Specific course-related costs: Some healthcare courses, for instance, come with additional bursaries that are worth looking into.

These grants are often overlooked but are a vital part of the funding available. If you're undertaking a preparatory course, it’s also a good idea to look into the specific options for Access to Higher Education funding to make sure you've explored every avenue.

Finally, while you're putting your funding package together, it's smart to think about your own financial safety net. Mature students often have more financial responsibilities, so looking into things like income protection cover can provide real peace of mind. It safeguards you against unforeseen events that might affect your ability to earn while you study. Combining government support with your own financial planning creates the strongest possible foundation for your journey.

How to Apply for Student Finance Step by Step

The student finance application can feel like a mountain of paperwork, but it’s a process you can absolutely conquer. Think of it less like a final exam and more like a checklist. When you break it down into smaller, manageable chunks, what seemed daunting becomes a series of simple, straightforward actions.

This guide is here to walk you through it, getting you from gathering your documents to hitting ‘submit’ with confidence. We’ll cover exactly what you need, how to handle the online system, and point out the common slip-ups that can cause frustrating delays. With a little bit of prep, you’ll get this done smoothly and correctly the first time.

Gathering Your Essential Documents

Getting your documents in order before you even open the application portal is the single best thing you can do. It saves so much time and stress down the line.

Here’s what you’ll need to have on hand:

- Proof of Identity: A valid UK passport is by far the easiest option. If you don’t have one, your original birth or adoption certificate will work just fine.

- National Insurance Number: This is absolutely crucial. You can find it on old payslips, your P60, or any official letters about tax and benefits.

- University and Course Details: Know the exact name of your university and the course you’re applying for. Don't worry if your offer isn't confirmed yet; you can always update these details later.

- Household Income Information: As a mature student, this will likely mean providing details for yourself and your partner if you live together. You'll typically need P60s or other proof of income for the relevant tax year.

Top Tip for Mature Students: If you're self-employed or have dependents, the evidence you need can be a bit more complex. Take some extra time to gather your Self Assessment tax returns or proof of any benefits you receive. Having these ready prevents that last-minute scramble.

Navigating the Online Application

Once your paperwork is all lined up, it’s time to tackle the online form. You'll find it on the official Student Finance website for your region (England, Wales, Scotland, or NI).

Here’s a simple breakdown of the process:

- Create Your Account: First, you'll set up an online account with a password and a secret answer. Keep these details somewhere safe – you'll need them again to check your application status and to reapply in future years.

- Fill in Your Personal Details: This part is straightforward, covering your name, address, and residency status.

- Provide Course Information: Here, you’ll select your chosen university and course from a dropdown list.

- State Your Loan Request: You’ll need to specify which loans you're applying for. For most people, this will be the Tuition Fee Loan and the Maintenance Loan.

- Declare Your Household Income: This is the section where you (and your partner, if applicable) enter your financial details. The system uses this information to calculate how much means-tested Maintenance Loan you’re entitled to.

- Review and Submit: Before you hit that final button, carefully double-check everything you've entered.

The demand for higher education is growing, which means more people than ever are applying. In fact, forecasts show that total student loan borrowing in England could reach £20.7 billion this academic year, with the number of new borrowers expected to jump by 10%. A big chunk of that increase is from mature students returning to education, which just goes to show how important a timely and accurate application is. You can read more about these student loan forecasts and trends on the official government statistics site.

Common Mistakes to Avoid

A tiny error on your application can unfortunately lead to big delays in getting your funding sorted. Be sure to watch out for these common tripwires:

- Missing the Deadline: If you're a new student, you should aim to apply by the May deadline. This gives them enough time to process everything so your money is ready for the start of your course.

- Incorrect Income Evidence: Make sure you're providing information for the correct tax year. Double-check that all the figures you enter from your P60 or tax return are spot-on.

- Forgetting to Sign and Return the Declaration: This is a big one. After you submit the form online, you still need to sign and post a physical declaration form. Your application isn't officially complete until they receive it.

Understanding Student Loan Repayments

The thought of taking on a big loan later in life can be a real stumbling block for many mature students. It's totally normal to feel anxious about debt, but it’s so important to understand that a UK student loan isn't anything like a typical bank loan or a mortgage.

A better way to think about it is as a 'graduate contribution'. Your repayments aren’t based on the total amount you borrowed, but on how much you earn after you finish your course. Grasping this one concept is key, as the whole system is designed to make returning to education a manageable step, not a financial burden.

How Repayments Actually Work

The system is built on a simple promise: you only pay back when you can afford to. You’ll make repayments as a small percentage of your earnings above a specific salary threshold. If your income drops below that line for any reason, your repayments automatically pause. Simple as that.

This income-contingent model acts as a vital safety net. It means you won't be chased for payments if you find yourself between jobs, decide to take a career break, or work part-time on a lower salary. The loan works around your life, not the other way around.

The key takeaway here is that the total amount you borrow is often less important than what you end up earning. You’re not chipping away at a fixed lump sum; you’re contributing 9% of your earnings over a set threshold for a limited time.

For most new students in England, repayments kick in once you're earning over £25,000 a year. If you’re an employee, it’s all handled automatically through the tax system, just like National Insurance. Your employer sorts it out on your payslip, so you never have to think about setting up a direct debit or making a manual transfer.

Key Details You Need to Know

Getting your head around the mechanics can bring some real peace of mind. Here are the core facts about the repayment system for anyone starting a course from 1 August 2023 onwards (this is called Plan 5):

- Repayment Threshold: You start repaying once you earn over £25,000 per year before tax.

- Repayment Rate: You pay back 9% of anything you earn above that £25,000 threshold.

- Interest Rate: Interest is linked to the Retail Price Index (RPI), which basically means it tracks inflation.

- Loan Write-Off: If there's still a balance left after 40 years from the April after you graduate, it gets completely wiped.

Let’s put that into a real-world example. Say you graduate and land a job earning £30,000 a year. You’re £5,000 over the threshold. You’d repay 9% of that £5,000, which comes to £450 a year, or just £37.50 a month.

What About Self-Employment and Growing Debt Levels?

If you work for yourself, the process is a little different but the rules are exactly the same. You'll work out what you owe when you fill in your annual Self-Assessment tax return. You still only pay 9% on your profits over the £25,000 threshold.

It’s also fair to acknowledge the headlines about student debt. Recent reports have shown a big rise in the number of UK borrowers with very large loans. By mid-2023, over 2.6 million people owed more than £50,000, with some balances even approaching £300,000. For mature students, who might already have mortgages or other commitments, these figures can look pretty scary. You can discover more insights about the scale of UK student debt on royallondon.com.

But that’s exactly why the income-contingent design and the 40-year write-off period exist. The system is specifically set up to ensure the headline figure of your loan doesn't lead to impossible monthly payments, creating a sustainable path forward for anyone considering student finance for mature students.

Common Questions from Mature Students

Figuring out student finance can feel like a minefield, especially when you're coming back to education after a few years away. You’re likely juggling a mortgage, a partner, and other financial commitments, which makes the stakes feel a lot higher.

We get it. That's why we've put together the most common questions we hear from mature students. Think of this as your go-to guide for real-world money worries.

Will My Partner’s Income Affect My Funding?

This is a big one, and the short answer is yes, it probably will. When you apply for any means-tested support, like the Maintenance Loan, Student Finance England looks at your total 'household income' to figure out what you’re entitled to.

If you’re over 25 and living with your partner (married, civil partnership, or just living together), their income gets added into the mix. This is totally different from younger students, where it's usually their parents' income that's considered. The thinking is that your combined earnings give a much better picture of your actual financial situation.

You'll need to dig out their income details for a specific tax year, which is usually two years before your course starts. This info is what they use to calculate how much Maintenance Loan you can get.

A top tip: get this sorted early. Find your partner's P60s or Self Assessment tax returns well before you apply. Being organised here means no delays in getting your funding confirmed, so you can actually budget for the year ahead without any nasty surprises.

Knowing this from the start helps you set realistic expectations about what support you'll get for your living costs.

Can I Get a Student Loan If I Have a Mortgage?

Absolutely. This is a myth that needs busting. Having a mortgage, a car loan, or any other kind of personal debt does not stop you from getting a student loan.

It’s a common worry that holds so many people back, but the student finance system isn't set up to penalise you for having built a life before going back to uni. The things they look at are completely different.

Here’s what they actually care about:

- Your residency status in the UK.

- Your previous qualifications and study history.

- Your household income (for the means-tested bits).

- Your chosen course and university.

Your personal assets, like your house, and any existing debts just aren't part of the calculation. It's a huge relief to know that being a homeowner won't stand in the way of you getting the funding you need to go for your degree.

Is There an Upper Age Limit for Student Loans?

Another question we hear all the time! The good news is that for the main loan covering your tuition fees, your age doesn't matter one bit.

For the Tuition Fee Loan, there is no upper age limit. Whether you're 30, 50, or 70, you can apply to have your course fees covered. This removes one of the biggest financial hurdles for older learners.

Things are a little different for the Maintenance Loan, which is the one that helps with living costs. Generally, you need to be under 60 on the first day of your course to be eligible for the full whack.

If you're aged 60 or over, you can still apply for a Maintenance Loan, but it’s a smaller, more heavily means-tested amount. It’s designed to offer a bit of help, but it's definitely something to factor into your financial planning if you fall into this age bracket.

What Funding Can I Get for Part-Time Study?

Studying part-time is a brilliant option for mature students, giving you the flexibility to fit learning around work and family. And yes, the funding system is set up to support you.

As a part-time student, you can apply for a Tuition Fee Loan to cover your course costs, just like a full-timer. The amount you get will simply be based on what your part-time fees are.

You might also be able to get a part-time Maintenance Loan to help with day-to-day costs. How much you get depends on your household income and, crucially, your 'course intensity'.

Course intensity sounds complicated, but it's just a percentage that shows how much of a full-time course you're doing each year. For example, if a full-time degree is 120 credits a year and your part-time course is 60 credits, your course intensity is 50%.

To get a part-time Maintenance Loan, your course intensity needs to be at least 25%. The higher the intensity, the more loan you could get. It’s a smart system that makes sure the support you receive matches your study load.

Sorting the finances is key, but many mature learners find that understanding the other challenges is just as important. You can read more about what to expect when you go back to school as an adult in our detailed guide.

At Access Courses Online, we specialise in helping adults get back into education with flexible, accredited online courses that pave the way to university. Our interest-free payment plans and expert tutor support make it easier than ever to invest in your future. Start your journey today.